The 4-Minute Rule for Am I eligible for a health insurance subsidy? - bcbsm.com

9 Easy Facts About American Rescue Plan Act FAQ - Vermont Health Connect Explained

Although the Medical Insurance Marketplace Calculator is based on actual premiums for plans sold in your area, there are several reasons that your calculator outcomes may not match your real tax credit quantity. For More Details , the calculator relies entirely on information as you enter it, whereas the Marketplace may determine your Customized Adjusted Gross Earnings (MAGI) to be a different quantity or might confirm your income against previous year's information.

Subsidy Calculator – Are You Eligible for a Subsidy? - eHealth

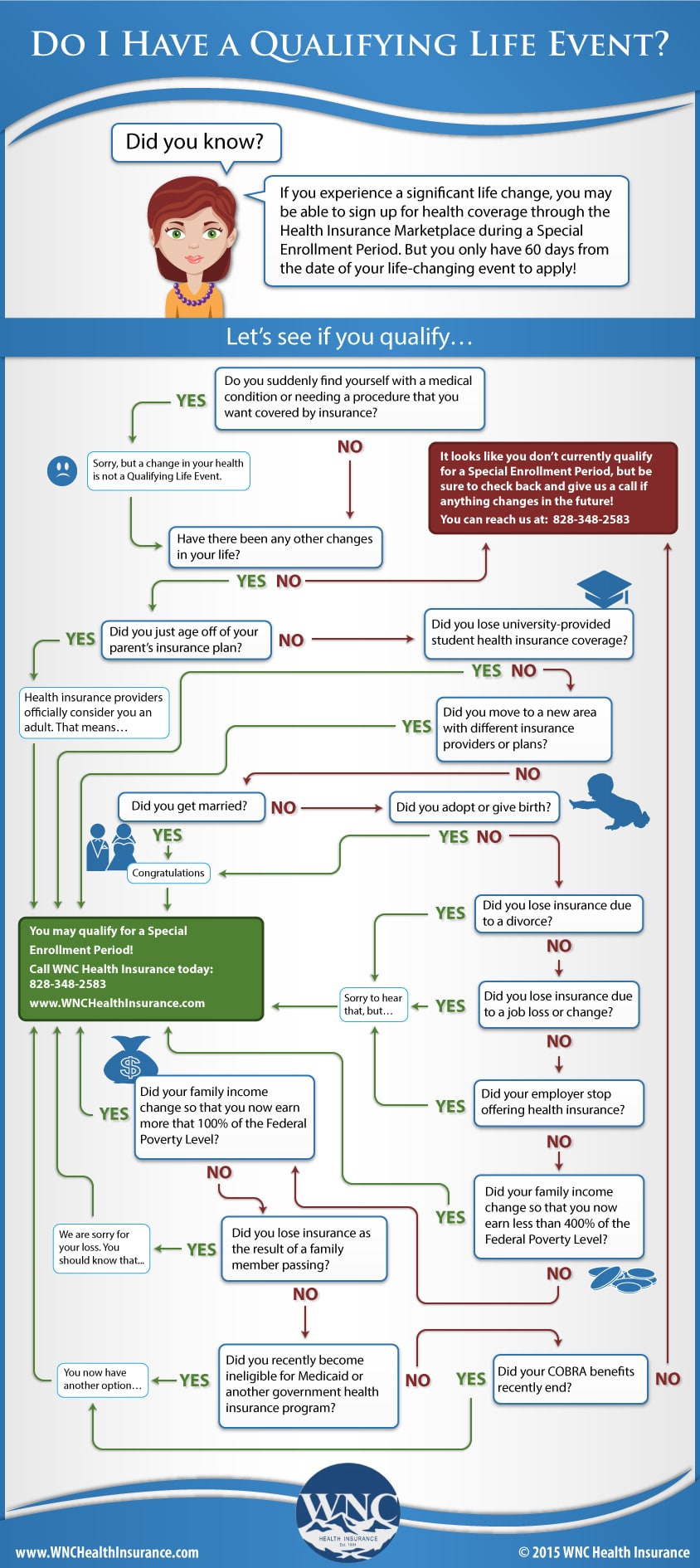

Subsidies are monetary help from the Federal government to assist you spend for health protection or care. The amount of support you get is identified by your income and household size. There are two types of health insurance coverage subsidies offered through the Market: the and the. helps lower your regular monthly premium costs.

Delivering for California Shoppers: Healthcare Subsidy

These individuals and families will have to pay no greater than 0% - 8. 5% of their earnings for a mid-level strategy premium (the "benchmark silver strategy"). Anything above that is paid by the federal government. The quantity of your tax credit is based on the rate of the benchmark silver plan in your location, but you can utilize your premium tax credit to buy any Market strategy, including Bronze, Gold, and Platinum strategies (these various types of strategies are explained below).

Are You On the Edge of the ACA Subsidy Cliff? - eHealth Insurance

Health Subsidy - Graduate and Postdoctoral Studies for Beginners

KFF Frequently asked questions provide additional details about how premium tax credits work. (likewise called "cost-sharing decreases") help you with your costs when you utilize healthcare, like going to the physician of having a hospital stay. These subsidies are only available to individuals purchasing their own insurance coverage who make in between 100% and 250% of the hardship level.

Unlike the superior tax credit (which can be utilized for other "metal levels"), cost-sharing subsidies only deal with silver plans. With a cost-sharing aid, you still pay the same low monthly rate of silver plan, but you likewise pay less when you go to the doctor or have a medical facility stay than you otherwise would.

If you have more specific questions about your aid, you can consult our frequently asked question pages or get in touch with an assister or navigator through Healthcare. gov or your state's Market. The Health Insurance Marketplace Calculator allows you to go into household income in regards to 2022 dollars or as a percent of the Federal poverty line.